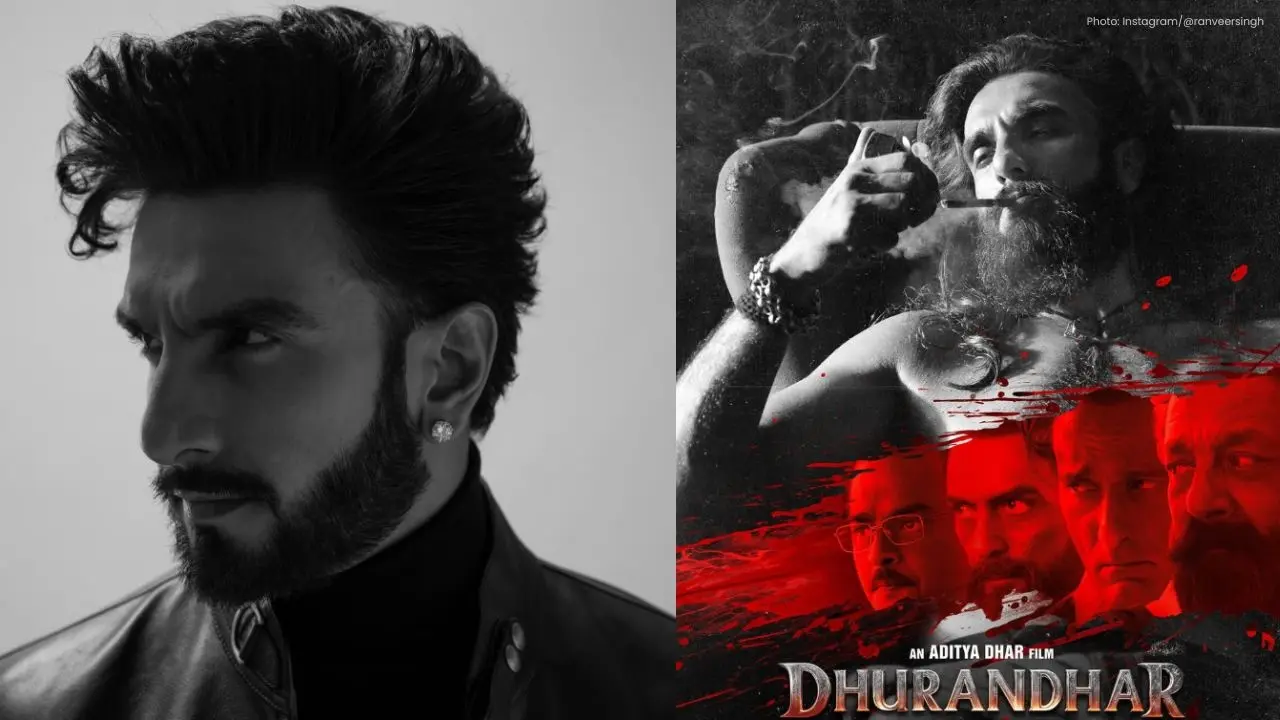

Ranveer Singh’s Dhurandhar Grosses Rs 871.9 Crore

Dhurandhar achieves impressive Rs 871.9 crore in six weeks, showcasing Ranveer Singh's exceptional t

In early 2026, gold futures have emerged as a focal point in the financial markets, amid a complex interplay of economic and political factors. Traditionally regarded as a safe haven, gold now faces a unique challenge influenced by growing inflation worries, geopolitical unrest, policy uncertainties with the U.S. Federal Reserve, and general macroeconomic trends that contribute to heightened directional risk.

As market participants weigh mixed signals—from robust U.S. economic data bolstering the dollar to political developments eroding confidence in central bank policies—traders find themselves caught in a crossfire of influences that could tilt gold prices upward or incite profit-taking. This article dissects the influences of inflation expectations, political landscapes, market structures, and risk in gold futures for 2026.

A key element steering gold price predictions is inflation—the rate at which prices for goods and services rise, eroding purchasing power. Heightened inflation fears typically drive down real yields (nominal yields adjusted for inflation), making gold an appealing store of value, as it doesn’t provide interest yet maintains intrinsic worth. Analysts have noted a resurgence in global inflation expectations, positioning gold as a potential safeguard against devaluing currencies and increasing living expenses.

However, inflation rates are not solely influenced by standalone factors. They are shaped by central bank policies, currency strength, energy costs, and overarching global economic conditions. If inflation persists while central banks maintain a loose monetary approach, gold’s appeal may increase. Conversely, if inflation pressures recede and central banks tighten policies, rising real yields could dampen gold’s attractiveness.

Gold’s reputation as a safe haven often shines in uncertain times—be it economic, financial, or political. Recent news highlights that geopolitical tensions and political shifts have fueled an uptick in gold and precious metal prices, as investors flock to assets viewed as stable stores of value during tumultuous periods. Gold’s longstanding role as a monetary asset underpins its capacity to preserve purchasing power when traditional markets face stress.

For instance, worries about international instability—from political happenings in the U.S. to tensions in the Middle East—have strengthened gold’s traditional appeal as a safe-haven asset. Such dynamics elevate demand for gold even during periods of mixed economic indicators, thereby exerting upward pressure on futures prices.

One significant political theme influencing gold markets in early 2026 revolves around discussions regarding the independence of major central banks, notably the U.S. Federal Reserve. In January 2026, reports surfaced of a criminal investigation involving the Federal Reserve Chair, stirring fears that political pressures could compromise the Fed’s autonomy. This event led to marked market reactions: a weakened U.S. dollar and a surge in gold prices as investors reassessed risks associated with monetary policy.

A central bank’s independence is vital for sustaining confidence in its decision-making regarding monetary policies. If policymakers are perceived as influenced by political motives—favoring rate cuts for political convenience rather than economic rationale—market uncertainty may rise, affecting real interest rate trajectories and inflation expectations, thereby influencing commodities like gold.

Geopolitical tensions globally—including crises in the Middle East, Eastern Europe, or Asia—also significantly sway gold markets. Heightened military risks, sanctions, or trade tensions can prompt investors to seek the relative security of gold, pushing up its futures prices.

Trade policies, especially between key economies like the U.S. and China, have historically impacted gold by reshaping inflation expectations, trade balances, and currency strength. Even the anticipation of such policies can introduce volatility in precious metals trading.

Recently, gold futures have demonstrated a rangebound pattern, suggesting a market struggle to break out decisively in any direction. Analysts remark that prices hover near recent highs yet remain within a technical framework indicative of balancing bullish and bearish sentiments. This compression in price movement implies traders are awaiting clearer indicators before taking substantial positions.

Directional risk in this marketplace denotes the uncertainty regarding whether the next major price movement for gold will skew upward or downward. With gold trading around critical technical levels, significant breakouts or breakdowns may occur, contingent upon forthcoming data or catalysts.

Market structure insights further highlight volatility trends. Tightening volatility bands often indicate a phase of consolidation, which typically precedes substantial directional movements once volatility increases. Momentum indicators derived from price movements assist traders in evaluating if gold futures are primed for continuation or correction. Analysts suggest that gold’s measured momentum amidst volatility bands demonstrates well-defined risk parameters, despite low directional convictions.

Historically, the relationship between the U.S. dollar and gold is typically inverse: stronger dollar values exert downward pressure on gold prices, whereas a weaker dollar tends to support them. Recent trends, such as strong U.S. economic data bolstering dollar strength and easing rate-cut expectations, have resulted in corrections in gold prices, despite ongoing safe-haven demand. Traders closely monitor the dollar index, given its influence on international pricing of gold.

Interest rate forecasts set by the Federal Reserve and other central banks also carry significant weight. Anticipated rate cuts generally favor gold, as lower rates lessen the opportunity cost associated with non-yielding assets. Conversely, robust economic data that postpones rate cuts can elevate real yields and potentially impede or reverse gold’s upward trajectory.

Gold usually showcases contrasting movements compared to equity markets: a rally in equities, spurred by growth optimism, often leads to underperformance in gold, while declines in equities due to risk aversion typically prompt gold rallies as traders seek safety. Political turmoil or disappointing earnings can indirectly bolster gold demand, further complicating the dynamics at play. Future movements in major stock indices possess the potential to shape gold futures by altering prevailing risk sentiments.

For investors eyeing gold futures, understanding the factors driving directional risks is paramount. With currents of inflation, geopolitical factors, and central bank policy at play, deploying strategies that accommodate various outcomes can aid in risk management. Investors often leverage a blend of technical analysis, macroeconomic indicators, and geopolitical developments to inform their investment decisions.

Diversification remains a cornerstone of effective risk management. While gold commonly features in diverse portfolios due to its low correlation with many asset classes, it's crucial for investors to recognize that during intense hedging phases, correlation trends can shift momentarily as markets search for liquidity and security.

Investors with long-term views might regard gold as a safeguard against inflation, currency devaluation, and systemic risks. Historically, gold has maintained purchasing power over lengthy durations, although this comes with periods of volatility. In contrast, short-term traders focus on immediate catalysts—like central bank discourses or political events—and usually exploit futures or options to profit from expected volatility.

As of 2026, gold futures stand at a critical crossroads where inflationary expectations, geopolitical tensions, and political currents converge to create directional risk. While safe-haven demand remains robust, elevated economic indicators and shifting central bank policies can introduce counterweights that may temper price increases. Traders and investors must carefully evaluate these competing forces to navigate this increasingly intricate environment.

With market signals indicating a consolidation and rangebound behavior, the next pivotal movement for gold futures is likely to arise from clear macroeconomic data releases, monetary policy shifts, or changes in the geopolitical landscape. Gaining insight into the interplay of these variables remains key to tracking gold’s trajectory in 2026.

Disclaimer:

This analysis is solely for informational purposes and does not serve as investment advice. Future market scenarios are inherently unpredictable; readers should conduct their research or consult a qualified financial advisor prior to making investment decisions.