DOJ Subpoenas Challenge Federal Reserve's Autonomy

Jerome Powell cautions that DOJ's subpoenas could undermine the Federal Reserve's independence and d

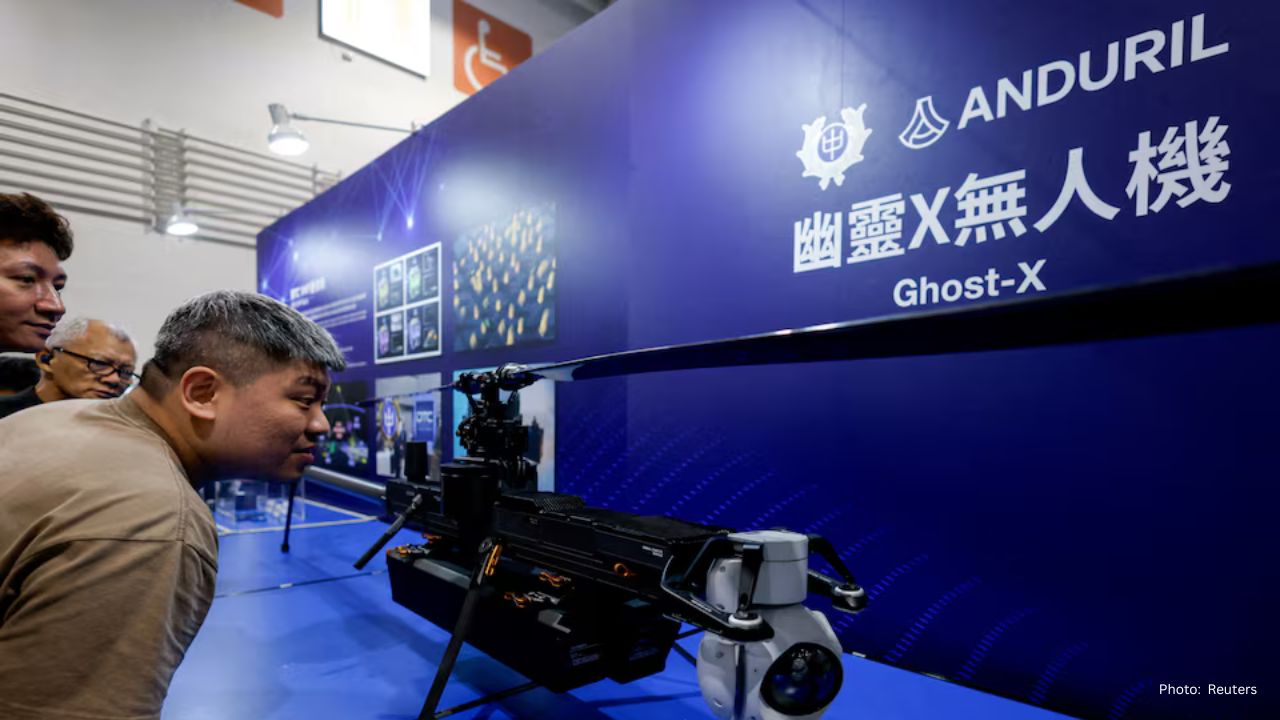

Giovanni Pennetta, a New York-based investment manager, was apprehended on allegations of defrauding investors through an illicit pre-IPO scheme related to Anduril Industries, a U.S. drone manufacturer. He was arrested at JFK Airport and is confronting charges including securities fraud, wire fraud, and aggravated identity theft.

Authorities have claimed that Pennetta misrepresented his ability to offer clients access to private shares of Anduril, collecting millions from investors who were misled by the promise of nonexistent stock options. The offers of “economic exposure” to the company’s shares were entirely fabricated.

His attorney has opted not to comment. Meanwhile, Anduril, valued at $30 billion following a funding round in June, develops drones and military AI software for the U.S. Department of Defense. The company has refrained from commenting but advised that any investment offers not directly originating from them should be considered suspicious.

This case underscores the increasing dangers associated with investments in private technology sectors. Recently, Anduril founder Palmer Luckey accused AlphaTON, a cryptocurrency firm, of defrauding investors after a $30 million investment in Anduril was abruptly canceled. AlphaTON and its CEO did not respond to inquiries.

Experts warn that private tech firms such as Anduril, SpaceX, and OpenAI are particularly at risk for fraudulent activity due to prolonged privacy that limits scrutiny and transparency. Investors are frequently misled through polished pitches, false documentation, and promises of exclusive access.

Daniel Taylor, director at the Wharton Forensic Analytics Lab, commented, “As private companies face less public scrutiny, they become more susceptible to fraud and manipulation.”

This incident reflects a broader trend. In September 2024, the Securities and Exchange Commission charged three individuals in a pre-IPO fraud that swindled $120 million from various investors. A separate scheme led to the arrest of three sales executives in New York earlier this year.

The arrest of Pennetta serves as a crucial reminder for investors to remain vigilant, verify opportunities thoroughly, and steer clear of deals that lack direct confirmation from the respective companies. Authorities continue to investigate this growing trend in private technology investments.