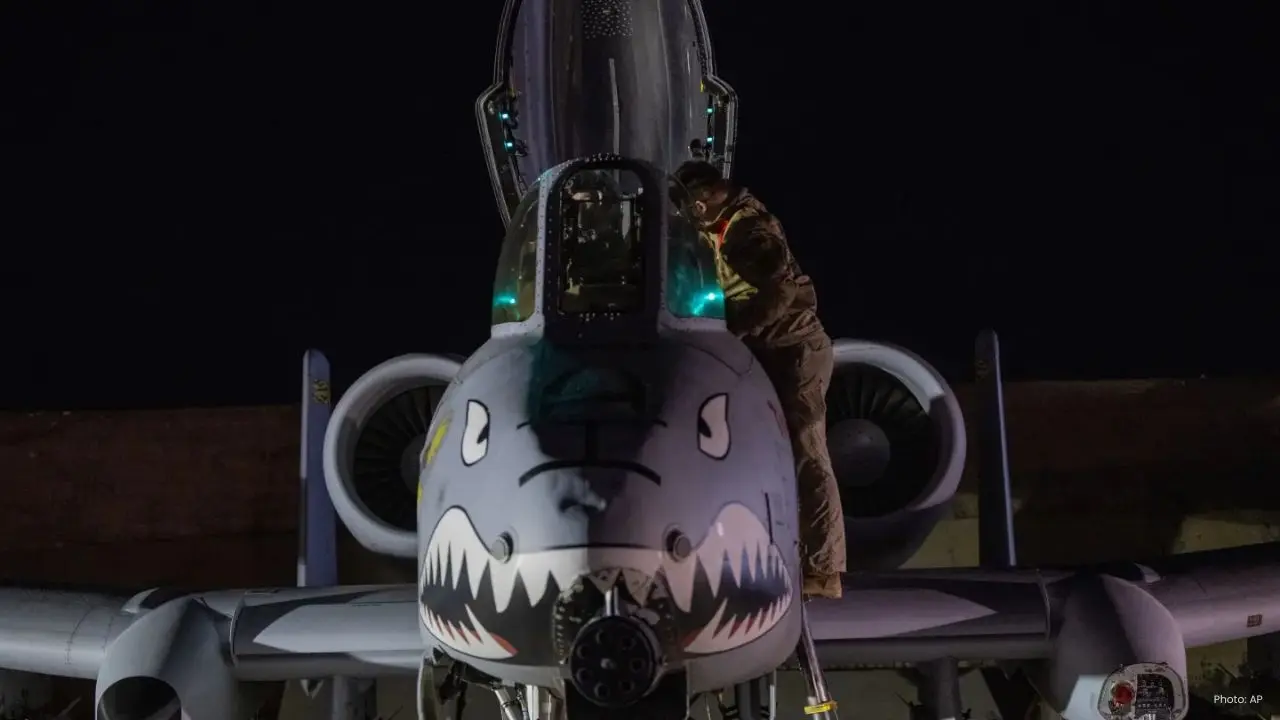

US Conducts New Airstrikes on ISIS in Syria Follow

In response to a deadly ambush in Palmyra, the US has launched fresh airstrikes against ISIS positio

The solar power landscape in China is revealing promising signs of recovery after facing substantial challenges characterized by significant losses and an overabundance of production. Recent data from an industry organization highlights that losses in the sector considerably dwindled in the third quarter of the year, as government measures took hold to manage overcapacity.

Historically, China has dominated the global solar panel and equipment production market. However, the rapid expansion of factories resulted in a production capacity nearly double that of global demand, leading to a chronic oversupply that slashed prices and led to considerable losses for many companies.

Information from the China Photovoltaic Industry Association shows a decline in aggregate losses by approximately 47% during the July-to-September period in comparison to the preceding quarter. Nonetheless, the sector still incurred losses exceeding 6.4 billion yuan, indicating ongoing pressures.

This positive trend coincides with Beijing intensifying efforts against industrial overcapacity, targeting solar manufacturing in this initiative. Authorities are determined to close dated and inefficient facilities while curbing the establishment of new ones.

According to industry representatives, the introduction of new production capacity has seen a decrease compared to last year. Although precise figures were not disclosed, it’s clear that growth is being controlled to rebalance the market. Concurrently, the production of polysilicon and silicon wafers—fundamental to solar panels—has faced significant reductions, aiding in diminishing supply excesses.

Despite these reductions, output levels for solar cells and finished panels have still grown in the early months of the year, demonstrating the scale and robustness of China’s solar sector, even amidst a downturn.

The implementation of new government regulations in 2025 has also contributed to this situation. Restrictions on energy consumption in polysilicon plants are leading to the shutdown of less effective factories. Officials anticipate this will boost overall quality and minimize waste in the long run.

Demand for solar energy remains strong in 2025, with expectations of new installations reaching a historic peak of approximately 285 gigawatts this year. However, analysts caution that demand could decline next year, possibly dropping to between 185 and 275 gigawatts in 2026.

Some experts warn that the new market-driven pricing regulations may pose challenges for solar developers, potentially hindering future installations. Yet, prominent industry figures remain optimistic; the chairman of Longi Green Energy expressed confidence that solar demand in China will surpass 300 gigawatts in the next five years.

Exports tell a mixed story; while volumes of finished solar panels have seen a slight uptick this year, their overall value has declined due to falling prices. Should domestic demand weaken, Chinese firms are likely to intensify efforts to seek overseas clients.

Ultimately, the reduced losses signal a positive trajectory for China's solar industry. While hurdles persist, more stringent regulations and sustained demand may pave the way for a return to healthier growth in the years ahead.