Shruti Haasan’s Warm Birthday Tributes for Kamal H

On Kamal Haasan's 71st birthday, Shruti Haasan shares a heartfelt video and affectionate messages, c

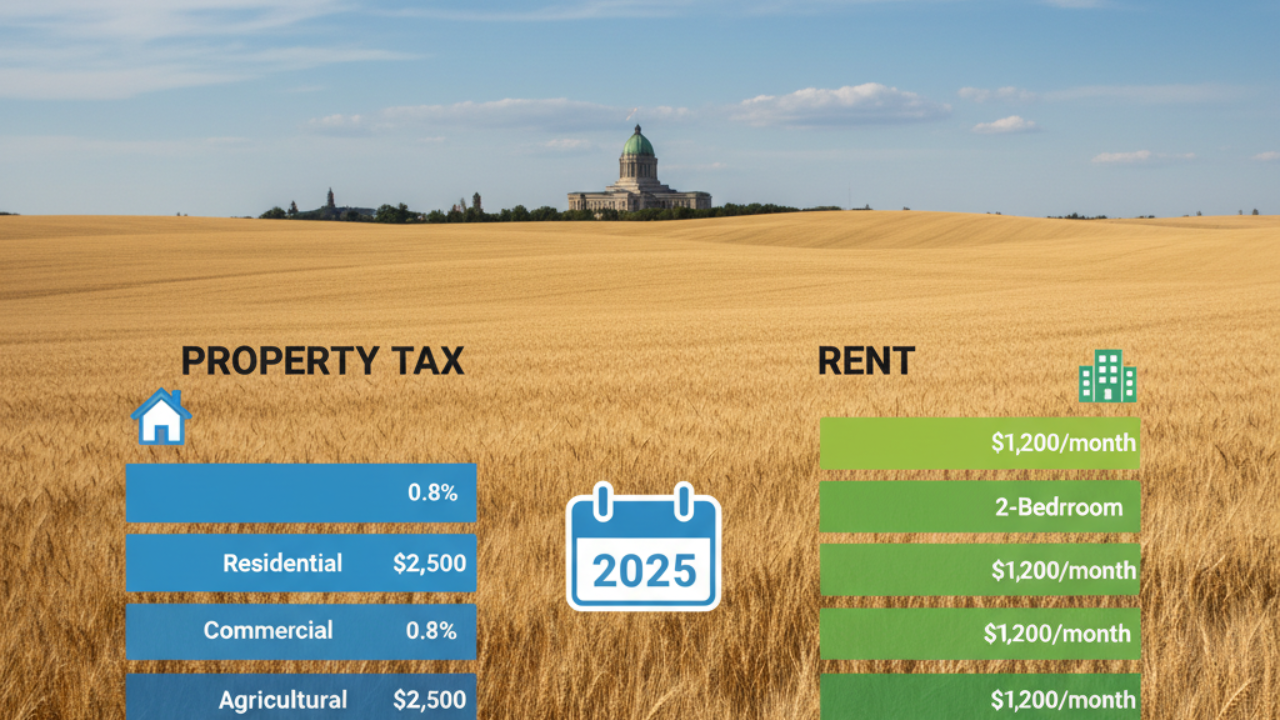

Housing affordability is a major consideration for residents and newcomers in Saskatchewan. Understanding property taxes and rent prices is essential for financial planning, whether you are buying a home or renting an apartment. This guide provides a detailed look at the latest rates and trends across key cities in 2025.

Property taxes vary depending on the city and property type. Here’s a snapshot of major cities:

Regina: Average residential property tax rate is around 1.2%, with municipal taxes funding local services, schools, and infrastructure.

Saskatoon: Homeowners pay roughly 1.1% of the assessed property value. Saskatoon invests heavily in public transport and recreational facilities.

Prince Albert: Residential property tax rates are slightly lower, averaging 1%, making it more affordable for families.

Moose Jaw: Offers competitive tax rates around 1%, with emphasis on community programs and public safety.

Property tax rates can fluctuate based on city budgets, assessment values, and local development projects. It’s advisable for homeowners to check official municipal websites for the most accurate data.

Rent prices are influenced by city, neighborhood, property size, and amenities. In 2025:

Regina: Average one-bedroom apartment rent is approximately CAD 1,200 per month, while a three-bedroom unit can range from CAD 1,800–2,200.

Saskatoon: Slightly higher rents, with one-bedroom units around CAD 1,300 and three-bedroom units averaging CAD 2,100.

Prince Albert: More affordable, with one-bedroom units around CAD 900 and larger units ranging CAD 1,400–1,700.

Moose Jaw: Average rent is lower, with one-bedroom units around CAD 850 and three-bedroom apartments at CAD 1,500.

Rising demand in major cities is contributing to gradual increases in rent, while smaller towns remain more budget-friendly.

Several factors influence property taxes and rent:

Location: Central areas often have higher taxes and rent due to convenience and amenities.

Property Size & Type: Larger homes or apartments with premium facilities cost more.

Municipal Services: Cities with better infrastructure and public services may charge higher taxes.

Market Demand: Rental and housing demand directly impacts pricing trends.

Research neighborhoods carefully to balance affordability and convenience.

Consider smaller cities for lower property taxes and rent.

Check for provincial or municipal incentives for first-time homebuyers.

Compare multiple rental options and negotiate where possible.

Disclaimer: This article is for informational purposes only. For accurate and up-to-date property tax and rent information, consult official municipal sources.